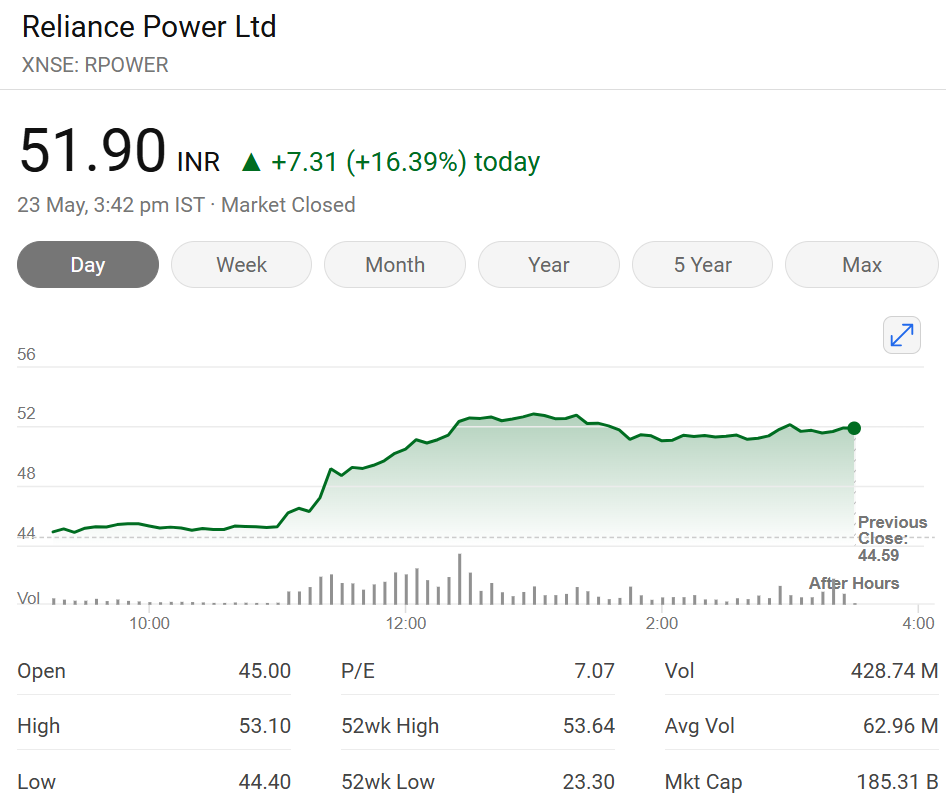

Shares of Reliance Power Ltd saw a strong jump of 18.66% on Friday, reaching a high of Rs 52.90 during the day. At the last update, the stock was trading 17.90% higher at Rs 52.57. With this rise, the share has gone up 17.53% so far in 2025.

Reliance Power has gained 20.77% in the last month, 51.98% over the last six months, and 99.13% over the past year. Over the last five years, it has gone up by a massive 2,820.56%.

Reliance Power shares continued to trade near day’s high, and were up 17.29 per cent to ₹52.29 per share. In comparison, BSE Sensex was trading 1.05 per cent higher at 81,802.05 level.

Anil Ambani-owned Reliance Power has executed a preferential allotment of equity shares aggregating ₹43.89 crore to two entities- Reliance Industries Limited and Basera Home Finance Private Limited. According to an exchange filing, the company allotted a total of 1.33 crore fully paid-up equity shares at ₹33 per share (inclusive of ₹23 premium). The shares were issued under the SEBI (ICDR) Regulations, following the exercise of rights attached to previously issued warrants.

Out of the total allotment, 33 lakh shares were allotted to Reliance Infrastructure, while 1 crore shares were issued to Basera Home Finance. Notably, the allotment price of ₹33 per share reflects a steep 26 percent discount to Tuesday’s closing price of ₹44.73, a move likely to draw investor scrutiny in the trading session ahead.

What sparked 19% rally in Reliance Power share#

The shares of the company were in great demand, as a total of 24.23 million equity shares worth ₹120.80 crore changed hands on the BSE, by 1:10 PM. Similarly, 282.43 million shares worth ₹1,410.25 crore had changed hands on NSE.

One of the main reasons for the rise in Reliance Power’s stock price is its recent partnership with Bhutan’s Druk Holding and Investments (DHI).

The two companies will set up India’s largest solar power project through a Rs 2,000 crore joint venture. The project will have a capacity of 500 megawatts (MW) and will be developed under a 50:50 partnership. It will follow a Build-Own-Operate (BOO) model.

In a statement, Reliance Power said, “The landmark solar investment in Bhutan underscores Reliance Group’s strategic focus on expanding its renewable energy portfolio, while reinforcing its long-term commitment to strengthening India-Bhutan economic cooperation. Reliance Power’s total clean energy pipeline stands at 2.5 gigawatts peak (GWp) in the solar segment, making it India’s largest player in the integrated solar and Battery Energy Storage System (BESS) segment.”

Reliance Power Q4 results#

Reliance Power reported a consolidated net profit of ₹126 crore in Q4FY25, driven by a major reduction in expenses. This marked a turnaround from the same quarter last year, when the company posted a net loss of ₹397.5 crore.

Total income in Q4FY25 declined to ₹2,066 crore, compared to ₹2,193.8 crore in the corresponding period of the previous year. However, total expenses dropped sharply to ₹1,998.49 crore from ₹2,615.15 crore, contributing to the improved profitability.

Stock Performance#

Shares of Reliance Power ended 2 percent lower at ₹44.73 on Tuesday, but have gained 12 percent in May so far, bouncing back from a 7 percent dip in April. Prior to that, the stock corrected 29 percent in March, 17 percent in February, and 6 percent in January.

Strategic Green Energy Push in Bhutan#

Adding to the buzz, Reliance Power recently announced a strategic international venture with Druk Holding and Investments Limited (DHI), the investment arm of the Royal Government of Bhutan. The two companies will jointly develop Bhutan’s largest solar power project, with a planned installed capacity of 500 MW.

The ₹2,000 crore project will be developed under a 50:50 joint venture on a Build-Own-Operate (BOO) basis. The agreement, marked as the largest private sector FDI in Bhutan’s solar energy segment to date, was formalized through a commercial term sheet with Green Digital Private Limited (GDL), a DHI-owned entity.

According to Reliance Power, the initiative aligns with its clean energy strategy and underscores its position as India’s largest player in the integrated Solar plus Battery Energy Storage System (BESS) category. The company’s clean energy pipeline currently stands at 2.5 GWp of solar capacity and over 2.5 GWh of BESS capacity.

As of May 7, 2025, the promoters held a 24.98% stake in Reliance Power, which is led by Anil Ambani.

(Disclaimer: The views, opinions, recommendations, and suggestions expressed by experts/brokerages in this article are their own and do not reflect the views of the India Today Group. It is advisable to consult a qualified broker or financial advisor before making any actual investment or trading choices.)